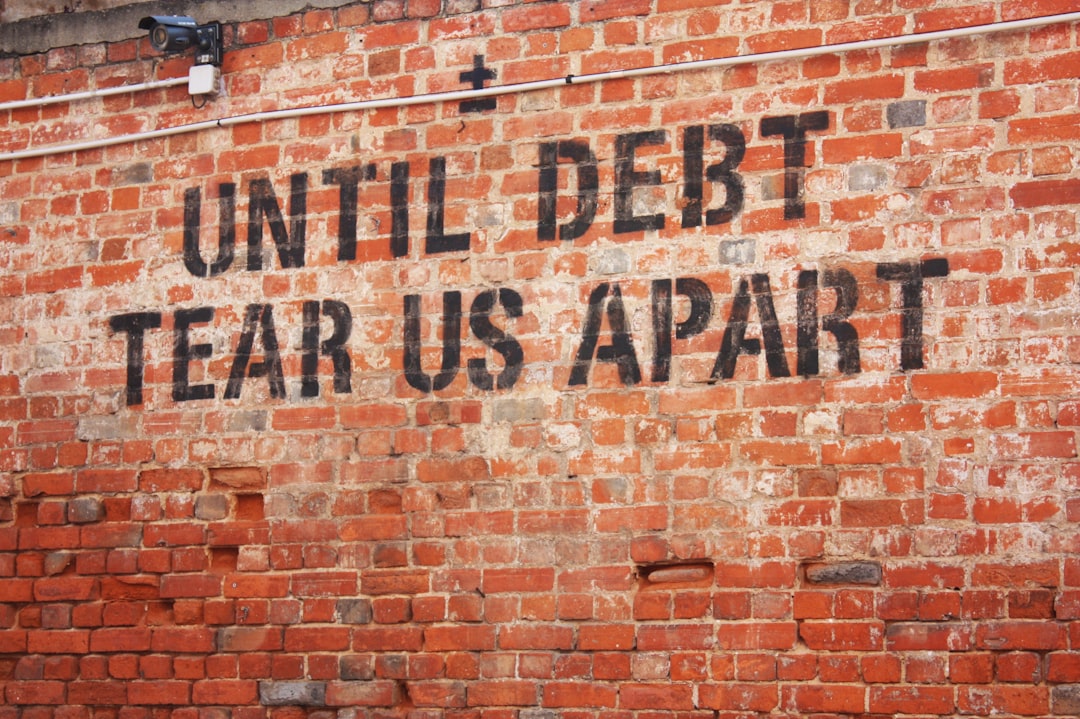

Mastering the Art of Debt Repayment: A Cynic’s Guide to 2025

Debt, that necessary evil of modern finance, often finds itself the villain in our financial narratives—and rightfully so. But let’s not be too hasty in our judgment; there are times when leveraging debt can be quite the strategic move. Whether it’s to fuel your educational pursuits, inject some capital into a fledgling business, or to cover the costs of a career-enhancing cross-country move, debt can be a savvy ally. Yet, even with the best intentions, the financial burden of debt can feel like a shadow lurking in your bank statements.

If you’re wrestling with the tentacles of debt repayments that just won’t let go, breathe easy—there are lifelines available. The debt repayment arena is brimming with strategies, each tailored to different financial predicaments.

Let’s peel back the layers of this financial onion by exploring these options, shall we?

**Key Considerations for Choosing Your Debt Champion**

**1. The Weight of Your Debt:**

How deep are you in? Are we talking a mountain or a molehill? Quantify your total debt—mortgage, car loans, those pesky credit cards, and yes, even those payday loans. Understanding the enormity of what you owe is pivotal. It’s the compass that will guide you through the murky waters of debt repayment strategies.

**2. The Flavor of Your Debt:**

Debt comes in various flavors, and each type has its own set of rules. Credit cards, store accounts, personal loans—they all play the game differently. Tailor your strategy to the type of debt you’re dealing with. For instance, consolidating payday loans might be a smarter move than shuffling your credit card balances around.

**3. The Interest Rate Jungle:**

Here’s where things get prickly. High-interest debts are like quicksand—the faster you escape, the better. Target these voracious interest-eaters first to prevent your finances from being swallowed whole. Consider options that sidestep interest altogether, like those tantalizing 0% introductory offers on balance transfers.

**4. Affordability:**

Can you keep up without breaking the bank? Your strategy shouldn’t just be about paying off debt, but also about keeping your financial sanity intact. If your coffers are full, go ahead and consolidate. But if you’re scraping by, settling for a lesser amount or negotiating a new repayment plan might be the way to go.

**5. Relationship With Your Creditor:**

Never underestimate the power of a good relationship. If you’ve been the poster child for timely payments, use that goodwill to negotiate terms if you hit a rough patch. A strong rapport could mean more lenient terms and even grace periods.

**Choosing Your Debt Slayer:**

Navigating through debt repayment strategies doesn’t have to be akin to a trek through Dante’s circles. Here’s a simplified road map:

– Start with a thorough credit report review. Know thy enemy—your debt.

– Budget like a boss. Keep track of what comes in and what goes out.

– Match your financial situation with the appropriate debt repayment strategy. It’s like choosing the right weapon for battle.

**Popular Debt Payoff Strategies:**

**The Debt Snowball Method:**

This method plays on the psychological win of clearing small debts first, building momentum as you go. It’s the financial equivalent of a snowball rolling downhill, gathering size and speed. Start small, end big, and watch your debts melt away.

**The Debt Avalanche Method:**

If the Snowball method is about momentum, the Avalanche is about strategy. Here, you attack the debts with the highest interest rates first, minimizing the total interest paid. It’s a methodical, calculated approach to burying your debt under an avalanche of payments.

**Debt Consolidation:**

Feeling overwhelmed by multiple debts? Consider consolidating them into one manageable lump with a lower overall interest rate. It’s like turning a cluttered desk full of paperwork into a neatly organized file—simpler, cleaner, and less daunting.

**Debt Settlement:**

If your financial ship is sinking, debt settlement might be your life raft. Negotiate to pay a lump sum that’s less than what you owe. It’s a hit to your credit score, but it could be a worthwhile sacrifice to keep your head above water.

**Debt Management Plan:**

Sometimes, you need a professional to take the reins. Nonprofit credit counseling agencies can work out a debt management plan for you, negotiating better terms on your behalf. It’s like having a financial coach in your corner, guiding you to debt-free status.

So, why invest all this effort? Because conquering your debts frees more than just your finances—it liberates your future. Each strategy demands dedication, but remember: the path to financial freedom is a marathon, not a sprint. Ready to lace up your running shoes?

Post Comment