Kick Debt to the Curb: 5 Revolutionary Money Moves for July 4th

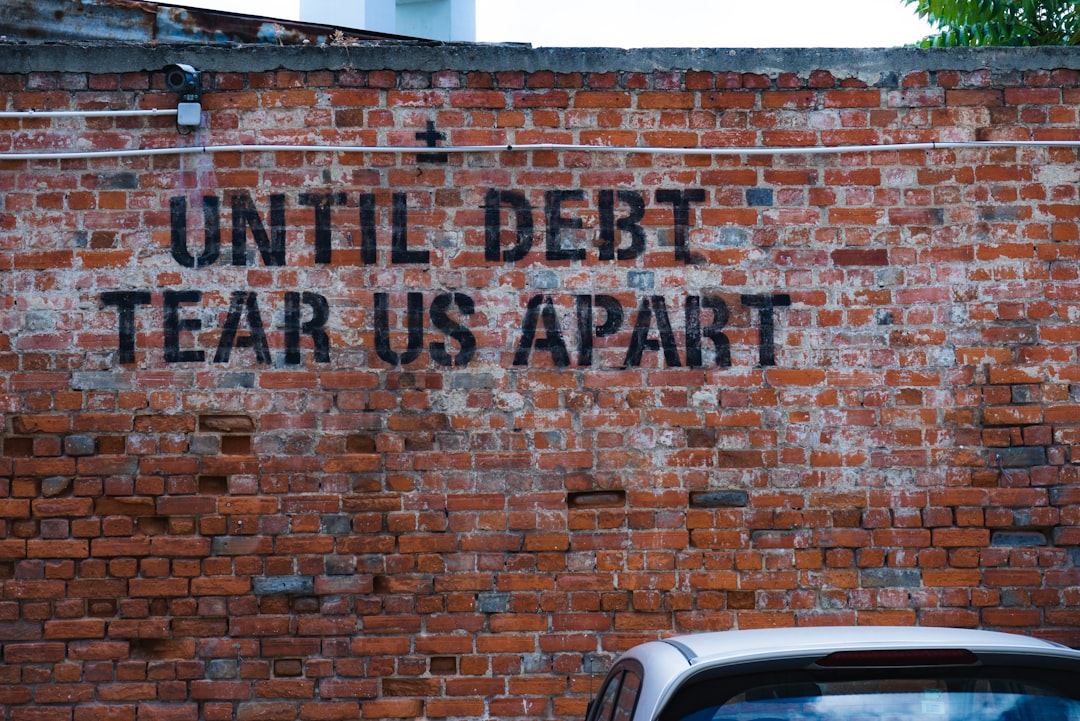

As the sky explodes with fireworks and the sweet aroma of barbecued delights wafts through the air, what better moment to ponder your personal revolution against debt? I confess, I’ve been shackled by debt’s relentless chains before—it’s as suffocating as the tyranny our forefathers rebelled against.

The stakes are high, folks. Recent whispers from KPMG suggest personal incomes have taken a nosedive—the first since 2021, with real disposable incomes limping along at a meager 1.7% year-over-year growth. And, as we’re pocketing less, we’re saving even less; the personal savings rate just dipped to 4.5% of disposable income. It’s a perfect storm for financial disaster when debt’s in the mix.

But here’s the ray of hope: just as our nation clawed its way to freedom, so can you from the clutches of debt. Let’s march through five battle-tested strategies to liberate yourself from financial bondage this Independence Day.

1. **Pen Your Financial Declaration of Independence**

Feeling besieged by an onslaught of credit card bills and daunting loan statements? I used to face my mailbox with dread, anticipating another tally of what I owed. Start your emancipation by sizing up your adversaries. Recent intel from PYMNTS.com shows non-mortgage consumer debt on the rise. Remember, you’re not alone in this skirmish.

**Action steps:**

– Rally all your debt statements—yes, even the ones that give you nightmares.

– Inventory each debt: note the balance, interest rate, and minimum payment.

– Calculate your total debt load.

– Target the debts with the highest interest—they’re your primary foes.

– Set a specific “Debt-Free Day”—your personal Independence Day.

I found scribbling “I, [your name], declare my financial independence” atop this document sparked a profound psychological commitment. It might sound corny, but sometimes, a dash of corn is just what the doctor ordered!

2. **Forge Your Freedom Fund**

Remember how the American colonies scraped together funds for their uprising? Your debt freedom needs a war chest too. A staggering revelation hit me recently—6 out of 10 folks are just winging it with their finances, as per a PYMNTS Intelligence report. Even high-income earners are floundering with foresight, down 25% in their planning prowess.

I was a savings disaster. Every attempt to stash cash for emergencies was thwarted by life’s unpredictables. But without a Freedom Fund, the debt cycle is unbreakable.

**Here’s your battle plan:**

– Establish a separate emergency account.

– Automate transfers—small sums like $25-$50 per paycheck.

– Make access a bit of a hassle (forget the debit card).

– Prioritize it like your rent or mortgage.

– Start with a goal of $1,000, then march towards covering a month’s expenses.

Think of your Freedom Fund as a fortress, safeguarding you from the surprise assaults of unplanned expenses.

3. **Adopt Guerrilla Budgeting Tactics**

The American revolutionaries outsmarted a superior force with unconventional tactics. Your budget might need some guerrilla warfare too. The financial landscape is brutal—KPMG reports a drop in personal consumption expenditures. It’s a sign folks are tightening belts.

My old-school budget was a battlefield disaster. I needed strategies with more stealth and strategy.

**Try these guerrilla tactics:**

– The cash envelope system: Use cash for discretionary spending. Empty envelope? Spend no more.

– The 48-hour rule: Pause before any non-essential purchase over $50. Impulse often fades with time.

– Zero-based budgeting: Assign every dollar a role. Make your income minus expenses hit zero.

– Expense audit: Every recurring expense must justify its existence.

– Debt snowball motivation: Attack the smallest debt with everything you’ve got, then roll that victory into the next battle.

Resisting budgeting? I get it. But remember, short-term fiscal discipline paves the way to lasting financial liberty.

4. **Form Your Financial Alliances**

During the Revolutionary War, America leaned on allies. Your journey to debt freedom might need some comrades-in-arms too. Different folks struggle with different debts, as PYMNTS.com notes.

I thought seeking help was admitting defeat, but forming alliances—both personal and professional—catapulted my debt-clearing efforts.

**Consider these alliances:**

– Accountability partner: Team up with someone who shares your financial goals.

– Financial advisor: Even a one-off session can tailor strategies to your needs.

– Creditor negotiations: You’d be surprised how flexible some creditors can be if you just ask.

– Debt consolidation: Sometimes, combining debts into one manageable loan is the way forward.

– Community resources: Tap into free financial counseling or aid programs.

5. **Celebrate Your Financial Victories**

America’s path to independence was a marathon, not a sprint. Your debt freedom journey mirrors this. Celebrating milestones is key to keeping your spirits high.

I still relish the memory of wiping out my first credit card debt—it was liberating. Instead of plunging headfirst into the next debt, I paused to savor the victory.

**Victory celebration ideas:**

– Create a debt freedom chart and mark your progress.

– Reward yourself on the cheap—a picnic, a free concert.

– Share your triumphs—they fuel further success.

– Journal your journey—it’s incredibly motivating to reflect on your progress.

Your Personal Financial Revolution

Just as America’s independence laid the groundwork for prosperity, carving out your financial independence sets the stage for wealth and tranquility.

Experts tout the 50/30/20 budgeting rule—needs, wants, savings. Try it, tweak it, make it work for you. And while you’re at it, remember to sprinkle a little joy into your life. After all, the goal isn’t just to survive without debt; it’s to thrive with financial freedom.

This July 4th, as you celebrate, picture a future celebration unburdened by debt. How would that freedom change your life? What doors could it open? What stress could it erase?

A good life isn’t about slashing every joy—it’s about smart choices with what you’ve got. It’s about crafting the freedom to live the life you dream of.

Are you ready to ignite your financial revolution? The time is now. Let the battle begin!

Post Comment