Why Your Credit Score Is the Unseen Force That Rules Your Financial Universe

Ah, the elusive credit score, that three-digit gatekeeper that can either pave your road to financial bliss or litter it with hurdles. You’ve undoubtedly heard the term bandied about while applying for loans, hunting for an apartment, or even setting up something as routine as a phone plan. For many, it’s merely a sporadic point of interest—or worse, something to be dodged like an awkward conversation. But let me tell you, your credit score wields more clout in your financial life than you might ever suspect.

Now, don’t be fooled; this isn’t just about snagging a credit card or securing a mortgage. Oh no, it goes much deeper. Your credit score dictates the interest rates clawing at your wallet, the hefty deposits demanded by wary landlords, and it can even be the unspoken player in your job search game.

And just when you think you’ve got it pegged, this sneaky number can change—without so much as a by-your-leave. A missed payment here, a new credit inquiry there, or an old account quietly bowing out can send your score into a somersault. That’s why keeping a vigilant eye on your credit is a crucial aspect of managing your finances, not merely a fleeting thought when a loan looms on the horizon.

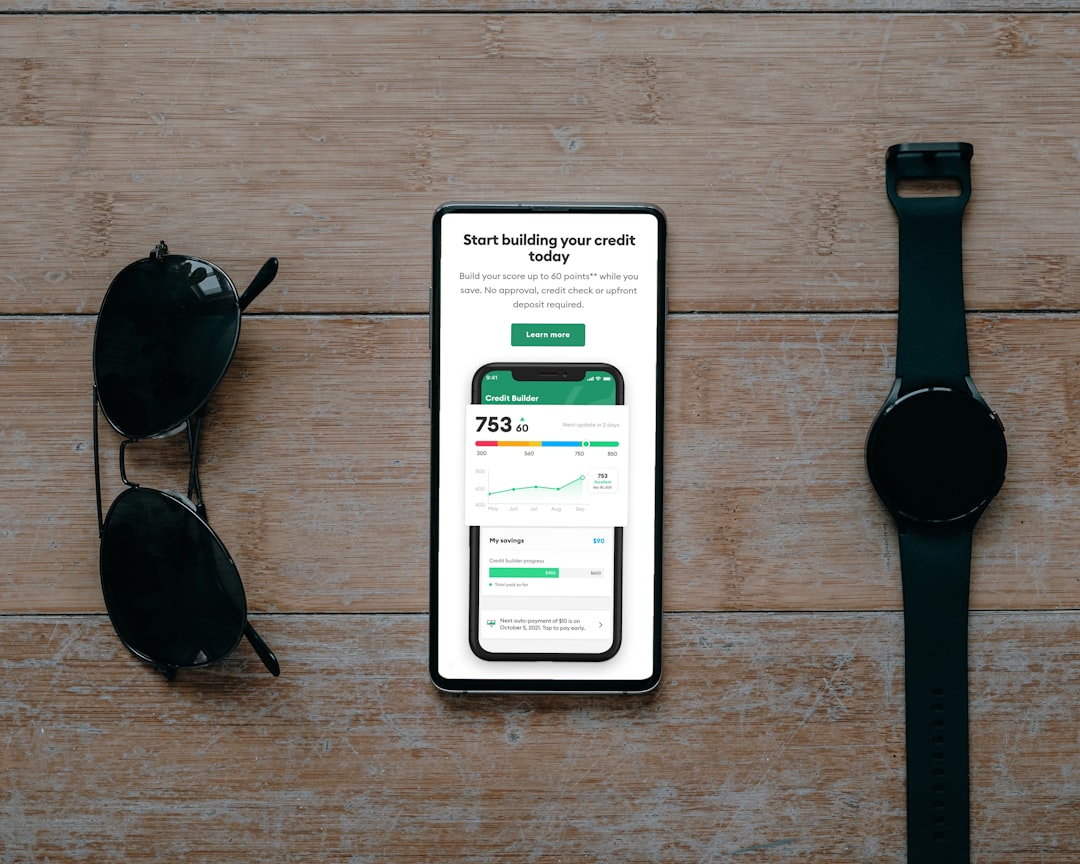

So, how do you get acquainted with this mysterious figure that holds such sway? Start simple: check your credit score regularly. Dive into your credit report with the tenacity of a detective. It might seem daunting, especially if you suspect the news might be bad, or you don’t quite know where to start. But here’s the kicker—you don’t need to be a financial whiz to stay informed.

The beauty of it is, peeking at your credit report doesn’t have to cost a dime. Thanks to free credit checks, you can spy on your score and report without denting your credit. These soft inquiries are like silent whispers that won’t tarnish your score; instead, they offer a transparent view of your financial dealings, alerting you to any potential identity theft or errors that need your attention. Keeping tabs on your credit doesn’t just safeguard your finances—it arms you with the confidence to make empowered decisions.

When it comes to borrowing, lenders scrutinize your credit score as if it’s a crystal ball revealing your financial past, present, and future. A robust score can swing open doors to favorable interest rates, generous credit limits, and desirable loan conditions. Imagine two people vying for the same $10,000 loan—one cloaked in excellent credit, the other in merely fair. The high-scorer could save a bundle in interest, cash that could fuel savings or family adventures instead.

And it’s not just about loans. Ever tried renting a home? That credit score of yours is under the landlord’s microscope, probing your ability to pay rent on time. A strong score can smooth your path to a lease, sometimes with perks like reduced upfront costs. Conversely, a weak score might mean forking over a heftier deposit—or facing rejection.

In certain job sectors, particularly those involving finance, government, or security, your credit report might as well be part of your resume. Employers scrutinize it, seeking reliability and sound judgment. While they won’t see your score per se, the report’s contents—outstanding debts, payment habits—can influence their decision.

Even mundane matters like car insurance rates or setting up utilities can bow to the power of your credit. Some insurers use credit-based scores to gauge risk, linking better scores with fewer claims. Utility providers might demand deposits if your credit history shows signs of instability.

Navigating money matters in relationships? Your credit score plays a pivotal role. It’s not just numbers; it’s about understanding each other’s financial attitudes, planning jointly for future goals, and building a sturdy financial foundation together.

Whether you’re building from scratch or repairing credit, the journey involves prudent credit use, timely payments, and keeping debt levels manageable. Regular checks and alerts can help you steer clear of pitfalls and celebrate your progress.

So there you have it. Your credit score isn’t just a number—it’s a cornerstone of your financial identity, influencing nearly every facet of your financial life. The good news? It’s not set in stone. With vigilance and smart habits, you can shape your credit score to better reflect your financial aspirations. Trust me, in the grand tapestry of your financial life, this is one thread you want to strengthen, not ignore.

Post Comment